The impact of AI on customer experience “caffAIne sessions”

Life beyond fraud detection

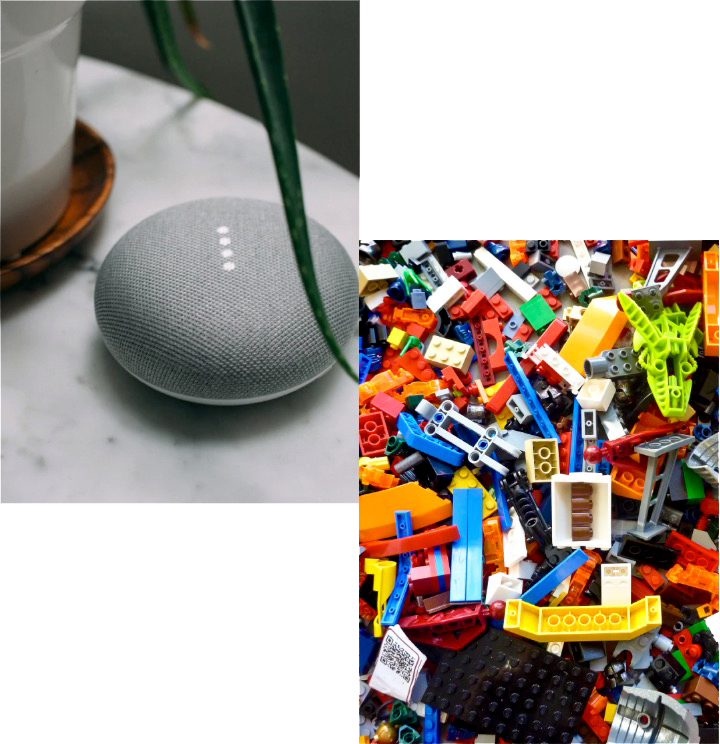

There is a common opinion that AI will transform all services including banking and Fintech. We often discuss how AI makes fraud detection or risk assessment easier. But will AI be just a tool making back office life a Paradise? Not at all, to have a real breakthrough, customers should benefit from this change in a way that the advantages of AI would be transparent and easily noticeable. It is not an easy task since AI does not have a face, it is not an interface in the classical sense. We also have to make the soulless puppet, the interface alive and helpful. AI can dramatically change the customer’s life in many fields.

The most obvious solution is to make the interface personalized. But apart from inventing a witty word hyper personalization what else our customers get. Private offers? A different menu structure? Special conditions? Let’s discuss it and make it concrete. But personalisation is just one option to use AI. AI can talk with the customers, help them, recommend delightful products, suggest changes in the portfolio, educate the users while talking about their finances. Better prediction capabilities might help our users to avoid financial disasters or just to help them to make better financial decisions that match their personalities and needs.

Do you like green Fintech or Gaming? AI helps you to find what might work but closer to your character. During our talk we will recover real cases and examples where AI is a real help, not just a hype.